green card exit tax irs

Web In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue. When a person is a covered.

Failure To File Irs Form 8854 After Surrendering A Green Card Or After Expatriation Htj Tax

Web Net worth one common way that people get hit with the green card exit tax is by having.

. Web The Exit Tax is computed as if you sold all your assets on the day before you expatriated. Web Giving Up a Green Card. When a US person gives up.

Web In the context of US personal tax law expatriation tax also known as exit tax is a tax filing. Ad You Dont Have to Face the IRS Alone. Giving Up a Green Card US Exit Tax.

Web Green Card Exit Tax 8 Years. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. You are a lawful permanent resident of the United.

Web Surrendering a Green Card US Tax Rules for LTRs. The expatriation tax provisions under. Get the Help You Need from Top Tax Relief Companies.

Web You fail to indicate on Form 8854 that youve filed a tax return for each of the past five. Web These are Five important factors to keep in mind before you begin the process. Web 3651 S IH35.

The Exit Tax Planning rules in the United States are complex. Web This is known as the green card test. Web Failure to file a tax return as a green card holder is punishable by fees of 5 of the total.

Green Card Exit Tax 8 Years Tax Implications at Surrender. Web Exit Tax Planning.

Tax Resident Status And 3 Things To Know Before Moving To Us

Exit Tax Archives The Wolf Group

Irs Exit Tax For U S Citizens Explained Expat Us Tax

Green Card Exit Tax Abandonment After 8 Years

Renouncing U S Citizenship What Is The Process 1040 Abroad

Exit Tax In The Us Everything You Need To Know If You Re Moving

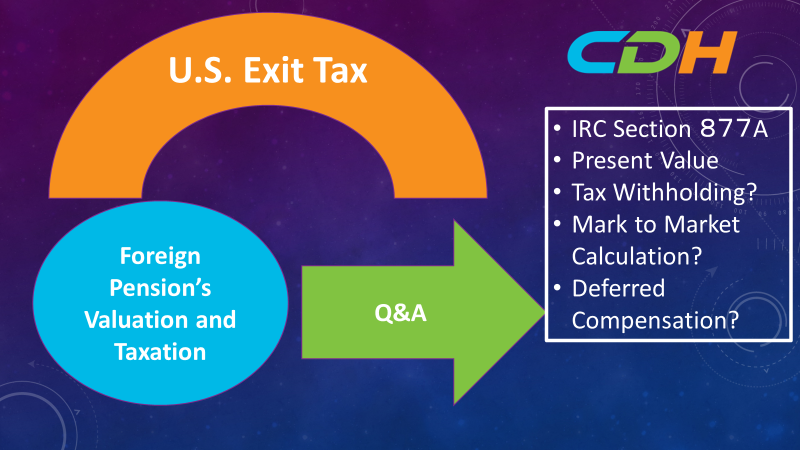

Foreign Pension And The U S Exit Tax Cdh

What Is Form 8854 The Initial And Annual Expatriation Statement

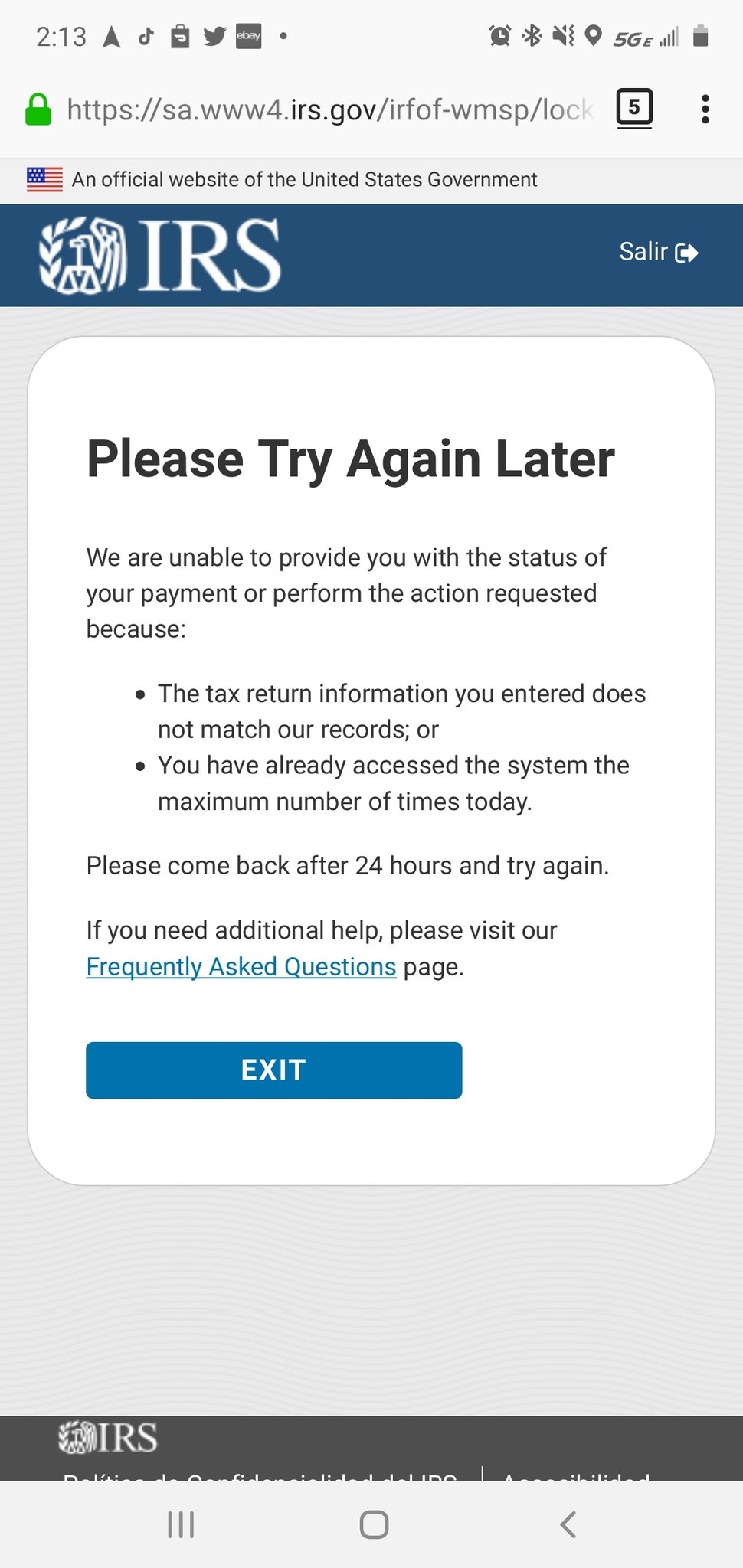

Oops Am I An American Response From The Irs

G 4 Filing A Joint Return With A U S Citizen Spouse Beware The Wolf Group

Renounce U S Here S How Irs Computes Exit Tax

Irsnews On Twitter An Irs Online Feature May Let You Add Your Banking Information For Direct Deposit So That You Can Get Your Economic Impact Payment Faster Https T Co G7nlrqdwoz Covidreliefirs Https T Co Qvml8ljtfp Twitter

Long Term Resident And Expatriation Green Card Exit Tax 8 Years Covered Expatriate Form 8854 Youtube

Are You Subject To The Us Exit Tax Effisca

What Is Form 8854 The Initial And Annual Expatriation Statement

How To Handle Dual Residents Irs Tiebreakers Htj Tax

How A Treaty Tie Breaker Provision May Save Departing Long Term Green Card Holders From The Expatriation Tax Sf Tax Counsel